Comprehensive delivery and seamless management of all credit products

FinoLane provides full capability to manage all types of credit products portfolio. Spanning loan origination of consumer/retail, commercial (MSME/Agriculture), personal loan/mortgages and various others, suiting your business and local market requirements. Including loans for SMEs, to large and complex businesses. With multi-layered, multi-language features, you can maximize market and business opportunities with FinoLane.

Commercial loans

- Investment loans

- Working capital loans

- Overdraft facility

- Credit accounts

- Credit/charge cards

- Preferential loans

- Refinance loans

- Guaranties and warranties

- Letters of credit

Consumer Loans

- Cash loans

- Installment loans

- Credit cards

- Revolving loans

- Overdraft facility

- Consolidation loans

- Car loans

- Student loans

Personal Loan/Mortgages

- Mortgage loans

- Equity loans

- Refinance mortgages

- Bridge loans

- Bullet loans

- Fixed & variable rate loans

- Mortgage credit insurance

Advanced capabilities and features of loan lifecycle

Capturing all operational stages of lending process is vital for loan origination to be efficient. FinoLane ensures a complete management of data collection, fund disbursement, and all stages in-between with advanced algorithms. With focus on delivering best in class services for African market and varied regional customers.

KEY FEATURES OF FINOLANE’S LOAN MANAGEMENT

Designed for African Continent

- Developed for African regions, markets & consumers

- Multilingual support (including local African languages)

- Dedicated partner support for each market

- Optimized for Branches (hub & spoke model)

Enhanced Performance

- Excellent UI & UX, for enhanced performance

- Advanced technology for faster processing

- Intelligent analytics and reporting module

- Intelligent analytics and reporting module

- Supports Java, TensorFlow & other latest platforms

Scalable & Flexible

- Modular design

- Easily integrates with existing systems

- Mobile App (Android & iOS compliant)

- API integrations

Fast & Secure

- Advanced encryption

- SSL certification

- PCI DSS (for Payment Security)

- Integration with local IT regulations

- 2-factor authentication (OTP, CAPTCHA etc.)

Customized for Local Compliances

- Easy integration of central banking regulations (like SARB, CBN etc.)

- Local laws compliant

- Fully customizable reporting

Cost Efficient & Convenient

- Made for African cost-conscious market

- Easy to train existing team for operations

- No investment on new hardware/software

Advantages for Lending Business

- Increased speed of processing

- Faster responses to customer’s needs

- Single lending product – complete info about the loan origination business

- Increased efficiency of the team

- Increased efficiency of the team

- Localized to African market – quick updates of legal or market conditions

- Immediate cost savings – pay only for modules you use

Choose modules as per your lending requirements. Easily add new modules as business expands. Flexible, scalable and secure.

Advantages for TEAM

- One product to manage all operations

- Drastically reduce & eliminate risk of error

- Single point of all data capturing

- Information and detailed reporting

- All digital operations (paperless)

- All digital operations (paperless)

Advantages for CUSTOMERS

- Customized for Africa – giving local service

- Multilingual support – best in class service

- Multi-branch management – apply from anywhere

- Digital and integrated with mobile and wireless technologies

- Speedy pre-qualification and decision

- Digital flow of all documentation

- Timely and informative notifications about application statuses

- Quick fund disbursement

Make your business of loan management more efficient. Shorten processing timeline & increase customer satisfaction

Advantages for TECH TEAM

- Flexible, scalable, well tested, can integrate multiple modules

- Easy to manage from remote branches/locations

- Reduced timeline of implementation

- No major training required for staff

- Developed to deliver enhanced performance

- Advanced & modern architecture

- Compatible with all digital & mobile platforms

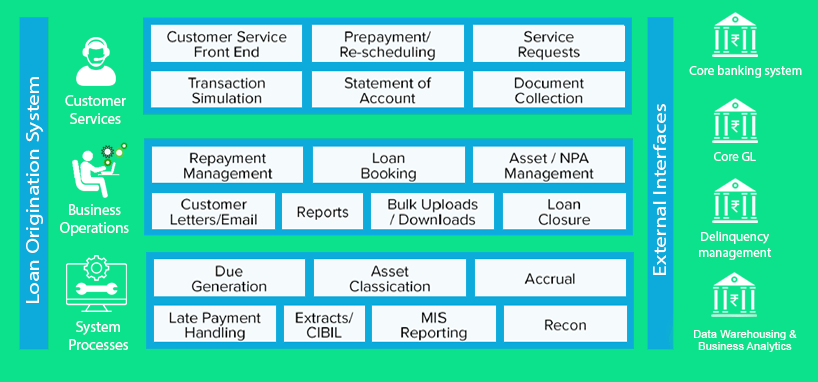

FinoLane Loan Management System Modules

Documentation Module – Generation and Processing

- Setup and configuration of document templates

- Addition of local legal clauses and conditions

- Customize depending on types of loans

- Seamless conversion in various formats

Management Module

- Management Module

- Easy search and response for queries and operations management

Loan Application Scoring Module

- Developed to accommodate various strategies for assessment of loan applications and credit risks

- Scoring module lowers various risks and makes decisions effective and efficient

Managing Collaterals Module

- Efficient synchronization of collaterals and master databases

- System registered collaterals can be used at multiple levels and multiple times as per business requirements

Structure Module

- Specific to customer’s organization structure, demographic connections

- Collate and store information at one place

- Easier to search and reference for quality decision making

Proper Covenant Management Module

- To effectively manage loan

agreements, especially types of loan, amount of credit, the rate of risk etc., its important to manage covenant properly. This module guides to keep the covenant information always sanctified

UNIQUE ADMINISTRATION MODULES

Process Module

- Information and engaging UI & UX design.

- No formal training required for using the modules.

- Tasks, roles and users can be seamlessly defined for starting operations in a very short time.

- Optimized for Branches (hub & spoke model)

Screen Module

- Preconfiguration of checklists, forms, and other interactive features from costumer and administration perspective

Integration Module

- Flexible to integrate the loan origination with any existing or new added APIs, platform or systems.

- Comprehensive digital capabilities across all forms of mediums including web and mobile.

Operations & Services Configuration Module

- Various business-related parameters can be easily updated and changed depending on market and customer needs or local banking regulations/compliances.

- Multiple lingual capabilities to enhance ease of use and smooth operations.

User Module

- All types of access rights, authentication, security, policy management, notifications, LDAP, SSO support can be easily managed through this module

Cost Efficient & Convenient

- Made for African cost-conscious market

- Easy to train existing team for operations

- No investment on new hardware/software